This model, introduced by the Bank for International Settlements (BIS), promises to revolutionize how financial ecosystems are interconnected.

A new paradigm for financial connectivity

With the introduction of the “Finternet” concept by the Bank for International Settlements (BIS), financial sector innovation has gained a new protagonist.

This model promises to revolutionize the way financial ecosystems interconnect, mirroring the universality and accessibility of the internet.

The goal is to eliminate barriers between different financial services and systems, establishing a global architecture that facilitates universal access to financial services through a robust and standardized platform using unified protocols.

Overcoming outdated financial infrastructures

Today, many financial systems still operate with outdated methods, marked by slow and costly processes.

They rely on traditional clearing systems and obsolete messaging infrastructures, which pose challenges, particularly in emerging and developing economies.

In these regions, limited access to basic financial services can hinder economic and social progress, keeping vulnerable populations on the margins of the formal economy.

The role of tokenization and digital identity

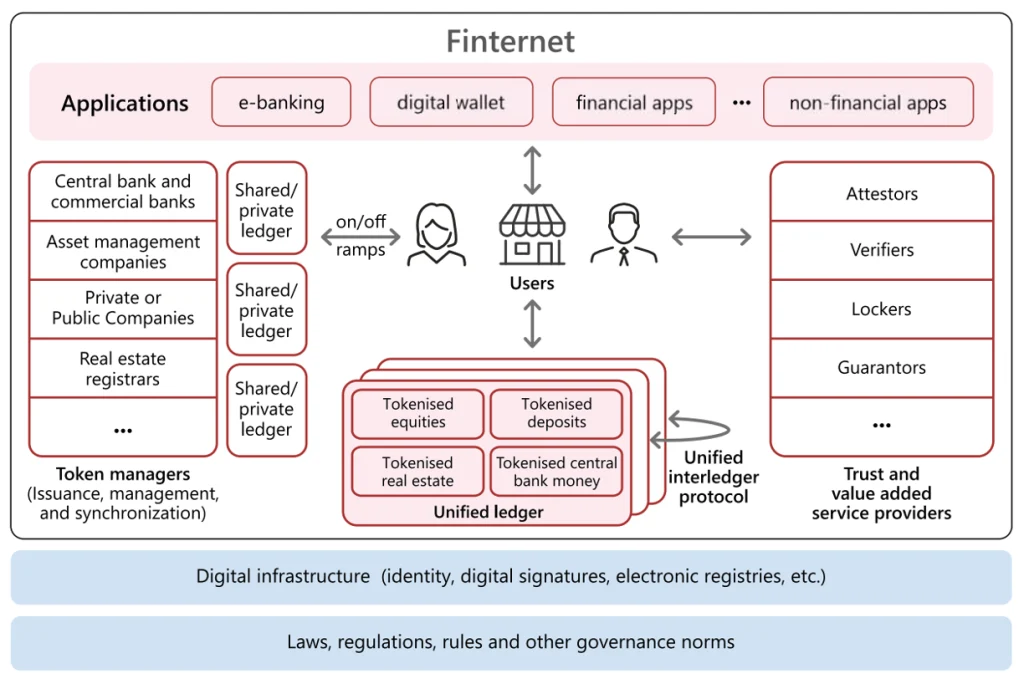

Incorporating technological advances such as verifiable digital identity systems and asset tokenization, Finternet emerges as a promising solution.

This technology has the potential to integrate millions of people into financial products, enabling secure, faster, and low-cost transactions.

- Tokenization eliminates the need for intermediaries in financial transactions.

- Unified ledgers can connect different asset markets into a single programmable platform.

Brazil as a global leader

Brazil is already paving the way for this transition, with an evolving financial agenda that includes:

✔ PIX – An instant payment system

✔ Open Finance – Data-sharing financial infrastructure

✔ DREX – The digital version of the Brazilian real

These initiatives not only demonstrate Brazil’s capacity for innovation but also establish the country as a model for the global adoption of Finternet, positioning it as a leader in discussions and development of this new financial infrastructure.

The challenges of global financial transformation

The design principles of Finternet—which emphasize usability, interoperability, and security—ensure that the financial system can adapt and evolve with technological changes and emerging needs.

However, significant regulatory and technical challenges must be overcome.

A proactive collaboration between the public and private sectors is essential to develop a financial infrastructure that is efficient and accessible to all.

Additionally, legal and governance frameworks need to be carefully planned to ensure the system’s integrity and security, while also fostering innovation in the private sector.

A more inclusive and connected global economy

In essence, Finternet represents a restructuring of global financial infrastructure, aiming for broader financial inclusion and a more interconnected digital economy.

With successful implementation, we can fulfill the promise of true financial inclusion. However, this ambitious vision requires collaborative efforts among all stakeholders governing the global financial system.

Brazil can play a crucial role in this transformative process.

📌 Article originally published in Finsiders Brasil.